[This post was originally published in June 2024]

Last month, I did an RV road trip through Oregon. When we drove through each city, I always spotted a few Dutch Bros coffee shops on the side of the road. The blue and white exterior was quite eye-catching. What's amazing to me, though, is that some of them are only less than a mile apart. That’s some shop density!

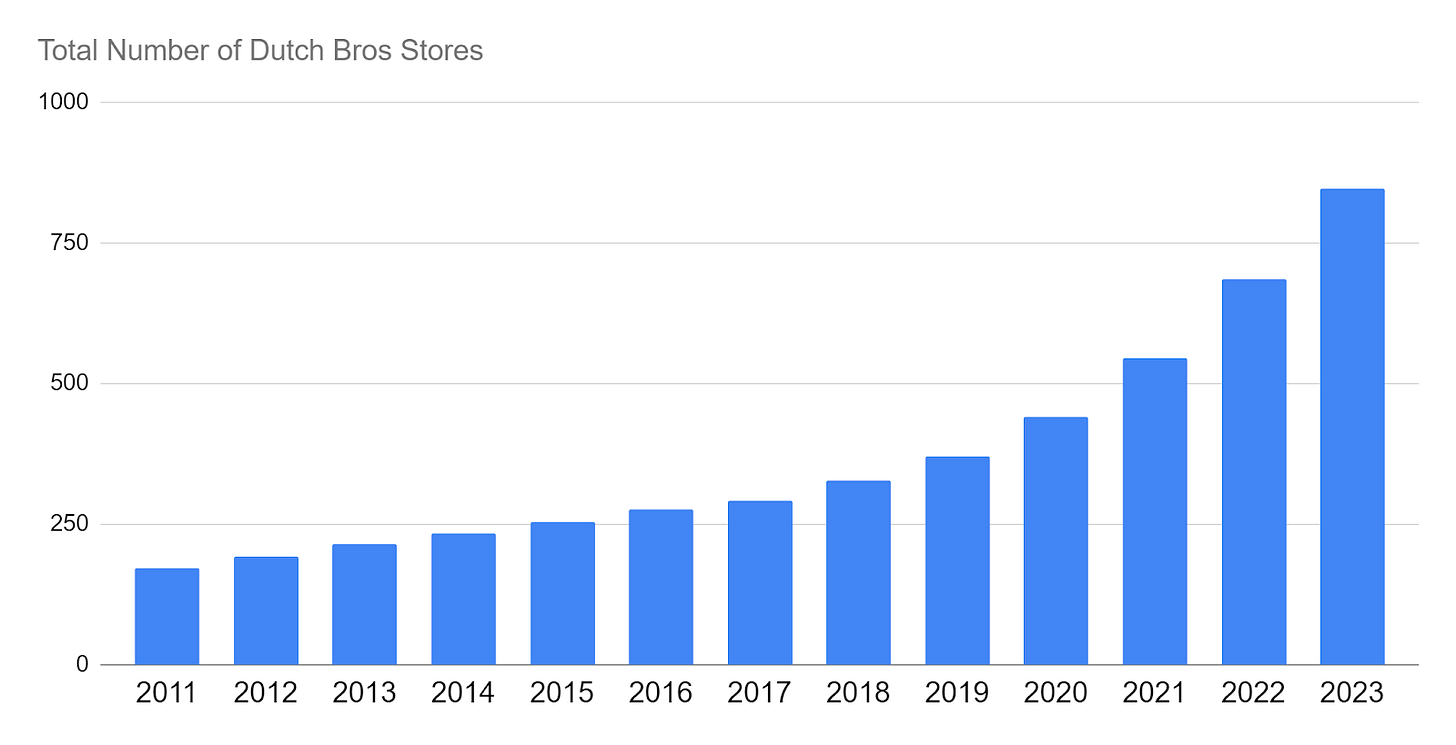

We stopped by one and tried their drinks. While my 3yo was dancing to the disco music at the stores, I glanced at their P&L on my phone. While BROS will have about 1000 shops at the end of this year, the majority of the shops are still on the west coast. If they could easily copy-and-paste their way to cover the whole country, they could 4-5x their revenue from here.

The Dutch Bros Story

Founded in 1992 by brothers Travis and Dane Boersma, Dutch Bros began as a humble $12,000 pushcart coffee popup in Grants Pass, Oregon. They used all their savings to start that single pushcart, marking the beginning of their business journey. After gaining traction from their then 5 pushcarts in 1995, the Boersma brothers moved into a drive-thru coffee shop that once inspired them to sell coffee. They gradually expanded into more branches, gaining a reputation for their friendly service and high-energy atmosphere which has since become the signature of Dutch Bros of today.

Sadly, Dane passed away due to ALS in 2009. Dane was seen as a “life coach” who inspired the team to think big and achieve their dream. Travis realized how important Dane’s teaching was fundamental to the success of Dutch Bros, so he and his core members took it personally to master Dane’s skill which has since been ingrained into today’s Dutch Bros culture.

Under Travis's leadership, Dutch Bros continued to grow, seemingly without compromising its culture, into 470 drive-thru locations across 11 states in 26 years.

In 2018, Dutch Bros received an investment from TSG Consumer Partners, a private equity firm that later invested even more capital and expertise. Recognizing areas outside his strong suits, like IT, Travis welcomed the additional resources TSG provided. They also brought in a new CEO, Joth Ricci, to help propel the brand toward its ambitious goal of 800 branches in five years.

During his tenure, Ricci improved BROS in all dimensions. He introduced new store layouts, new menus, loyalty programs, and more. The brand also benefited from the shift in behavior especially during the coronavirus pandemic as people prefer less interaction.

Fast forward to today, Ricci has fulfilled his promise of achieving 800 branches and has passed on the torch to Christine Barone, the current CEO. Throughout these changes, Travis remained involved in the expansion of the business, making sure BROS culture and legacy scale as fast as the shop itself. The team sets sights on 4,000 branches nationwide within the next decade.

Any company expansion will be faced with challenges along the way. For Dutch Bros, they’ve got to deal with training their people, racing against competitors who are replicating their success, and innovating against incumbents like Starbucks who are prioritizing more drive-through models.

And for investors, we’ve got to figure out the risks and rewards, and how much of Dutch Bros' success is priced into the stock today.

In this deep dive, I’m taking a stab at answering these questions. Enjoy!

I will break this deep-dive down into 5 Parts:

BROS Business Model: Examining their product, process, and expansion plan. What makes BRO unique?

Industry, Competition, and Long-term Questions: Analyzing their competitors. (And it’s not just Starbucks!)

Financial Modeling and Valuation: Valuing BROS using a reverse DCF model.

Management Team, Capital Structure, and Capital Allocation: Evaluating the leadership and financial strategy.

Conclusion: My take on the current stock price.

[disclaimer: All of this is my opinion, please make your own investment decision]

Part 1: BROS Business Model

“We may be a coffee company, but we are in the relationship business."

Product: What makes Dutch Bros unique?

Per their IR website, BROS describes themself as “a drive-thru shops that focus on serving high QUALITY, hand-crafted beverages with unparalleled SPEED and superior SERVICE.”.

To me, Dutch Bros has effectively met these objectives at scale, thanks to their ability to effectively manage the company culture. But before we talk about how they achieve that, let’s follow the customer journey exploring their drive-thru layout, drinks menu, and customer interactions.

The shop is designed especially for Drive-thru

Dutch Bros stores are usually located near the trade area in the suburbs where land cost is not too expensive and traffic is less heavy. You might see them pop up from the unused parking spaces of the big retailers or developers. Most stores can be seen from the main road where there are a lot of commuters.

As you drive into one of the new BROS shops, you will realize right away that the lane and building design is quite different from a typical coffee drive-thru like that of Starbucks or Dunkin’. Sometime after starting their first drive-thru in 1995, they added the second lane to increase throughput. In later years, they came up with what I would call “Next-Gen Drive thru coffee” model, labeled as “Current Configuration” in their investor presentation.

The new model has two lanes that converge to one before the shop. It also has an exit lane that lets customers behind go pass in case they receive their drink first. While drive-thru lanes always get priority, the new format also comes with some open-air seating space. This allows customers to hang out briefly and pick up pre-ordered drinks (currently being rolled out); however, the place isn't intended to be a “third place” like Starbucks stores which comes with extra costs and investment.

During busy times like in the morning, “the runner” staff will leave their box and come take the order via an iPad which sends the order inside the shop. In some cases, the car behind gets the drink first, and that runner will take out the drinks and hand them to the car. That customer can then use the exit lane to leave right away.

These changes might seem rather trivial, but I believe that this format really improves the drive-thru experience. Under this format, there is more space for lines, the lines also look shorter, and the “runner” staff who “bust the line” can take orders quicker. For me, it is akin to having a best-in-class checkout page for its e-commerce website which, though serve the same function, has a much higher conversion rate than its rival’s service.

The new design from BROS’ Presentation

Another proof that this design works is that this design has been copied by many Dutch Bros copycats competitors as well. This Google Maps Satellite view should give some idea of Dutch Bros vs Typical Standalone Starbucks or Dunkin’s store design which prioritized in-store visits. This is why the drive-thru experience of their legacy stores will never be as good as DutchBros.

A typical Dutch Bros Drive-thru

Typical Dunkin’ and Starbucks Drive-thru. Prioritized parking space and limited drive-thru lanes.

The hand-crafted Drinks

Dutch Bros prides itself on all its drinks being masterfully handcrafted by their Broistas (Barista). In their “Dutch Manifesto” employee handbook, they list out great details of each step of preparing the drink, from grinding the coffee bean to pouring the drink into the cup.

Today, Dutch Bros’ product offering has extended way beyond regular espresso offered from their coffee cart in 1992. In fact, coffee made up just 50% of sales. Another one-quarter of all sales come from their branded “Blue Rebel” energy drinks which was added about a decade ago. The rest is from non-coffee drinks like smoothies, tea, and lemonade. Likewise, the coffee section on their menu takes less than half of the menu space. This mix reflects the demographic of their customers which skews toward female and Gen-Z.

Apart from this basic Menu, BROS also has secret menus and allows the customer to do a variety of customization to their drinks, such as choosing their own syrups flavor into their coffee. They also continue to test new products into their current offering, such as Boba and Protein coffee, both of which cater to the young adult fanbase as well.

The taste of the coffee itself is subject to debate. Their beans consisted of 100% arabica beans from Brazil, Colombia, and El Salvador. I personally have no idea what each bean tastes like. “Coffee experts” on Reddit and Quora would say that Dutch Bros coffee is rather a sugary drink than a “real” coffee but the young millennials and Google Maps reviews seem to disagree as they keep coming back for more. Readers, please let me know what you think too!

In terms of pricing, the drinks are generally priced slightly lower than those of Starbucks’ but a bit higher than other drive-thrus chains. The price varies state by state.

Positive customer interactions

“We would have fun trying to change people’s moods. We wanted to make everyone smile and create a magnetic, contagious experience. That lives on in our company. It’s our culture and differentiator.” - Travis Boersma BBH interview

Dutch Bros is very deliberate on maximizing positive human interaction. To describe the experience, Christine Barone, the current CEO, was asked how the touch and feel of Dutch Bros is different from other brands like Starbucks and Dunkin’ at a William Blair Conference. This is her answer:

“So a couple of things, we don't have a squawk box, if you pull through the drive through, you're actually greeted by a person, and they'll ask you how your day is, they'll ask you what you want to drink, if you want to be guided through choosing your drink, you'll have a full conversation, and then we have a really unique model at our drive thru window. So when you're sitting at the drive thru window as the Broista there, you never turn your back to the customer in the car.

And … it's very rare when you go through a drive thru, when the person at the window is also looking to see who are the passengers in your car, do you have a dog, is there a kid in the back, … they're also engaging the entire car.

“..to have someone who genuinely and authentically has the time and wants to connect with you is something really, really special. .. The team has the right amount of time to both make your drink perfect but also engage you at the level that you want to be engaged.”

Although I have been there twice, our experience with BROS was great. The Broista made eye contact and asked my boy’s name. It was a good impression overall. Great service and makes bad coffee tolerable, makes average goods and makes good ones worth sharing. Google Maps reviews of BROS stores are also pretty good. While about half of the bad reviews are from long lines which, for an investor, is a good sign! All of this turns into repeating customers and word of mouth.

Good service also leads to tangible operational improvement as well. This study from Intouch Insight found that friendliness doesn’t just bring more customers back but also improves order accuracy and overall speed. Better service should also mean better tips.

The question is, will Dutch Bros’ friendly service go out of style as their customers grow up? I tend to think the opposite. People these days experience less face-to-face communication, and having some good conversation is a great remedy. I rarely see complaints that staff at In-N-Out, Trader Joe’s or Chick-fil-A are being too friendly or welcoming. Friendliness is what most store owners wish from their employees, but only a few brands can achieve this consistently. And if a customer ultimately prefers less interaction, the staff can just dial down the dialogue.

A page from the Mafia Manifesto (employee guidebook) describes how a Broista should interact with their customer.

But how did they achieve this?

Having clear instructions on everything is one thing, making sure all employees wholeheartedly follow them is a much harder task. To achieve this consistently over the decades requires a strong company culture. Dutch Bros is all about cultivating good relationships for which Travis and his core family members are still there to keep them in check. He made it clear from the day he got outside investment from TSG that culture is his number one priority.

“...As the captain of the ship, my commitment is to ensure the people and the brand and the culture are all protected. If we can’t scale with culture as the No. 1 priority, then I won’t grow…” - Travis Boersma from Biz Journal

A strong culture allows the company to find people with a good fit to BROS's mission. For example, Barone mentioned in a conference “Our teams are looking to join Dutch Bros because they like that sense of belonging. They feel like they're a part of a really incredible team..”

Not only that, BROS has been shown to create goodwill with other stakeholders. For example, in the 2010s, they faced a warehouse fire but their business survived as they received the much-needed help from their banks and suppliers.

Travis’ emphasis on culture trickled down into business tactics such as::

Prioritizing Service quality before branch growth.

Having rigorous training and quality control. Every employee must train as a Broista for two weeks and do the “flow check” test that even the CFO had to take twice to pass.

Being proactive in giving raises and slightly overpaying staff above the market rate.

Providing ample training time and good learning material (they have Dutch-Bro Uni apps, examination, and manifesto for Broistas to learn from).

Promoting managers only from within and franchising out only to Dutch Bros employees who have at least 3 years of working experience at BROS.

Staying in touch with community and philanthropy efforts, which, looking through social media like Reddit and TikTok, seems to resonate with their customers and staff.

Broista Career Path. 10-K 2023

Travis and his team know how to create a good company culture.

All in all, if I were to pick a trait that makes Dutch Bros truly stand out from their competitors, it would be the people-centric culture that has been kept until today. But, just like in the retail business, I don’t think that one factor is enough for Dutch Bros outsize success. Menu innovation, drive-thru experience improvement, service, and marketing, are also required to reach this current level of success. Right now, they seem to have found the winning recipe to success that allows their shop to have great unit economics which allows them to replicate their model to the entire country.

Unit Economics

The company has two types of stores, company-operated stores and franchise stores. As of Q1 2024, there are 582 company-operated stores and 294 franchise stores.

Although Dutch Bros no longer accepts new franchisees, the current franchisees can still expand in their designated area, mostly in the western states. Franchise stores pay a one-time license of $30,000 per shop, an ongoing 5% Royalty Fee based on sales, a 1% Marketing fee also based on their sales, and must buy the main ingredients from Dutch Bros. The Overall take rate from the franchisees hovers around 18% of their sales, and the gross margin is about 70%.

Store types breakdown - BROS 2023 10-K

Since future expansions will mainly come from company-owned stores, let’s dig deeper into their store unit economics.

Company-owned units:

In 2023, ramped-up Dutch Bro stores boasted an Average Unit Volume (AUV) of $2M, rivaling some well-known QSR brands and Starbucks. Amazingly, some stores' AUVs are as high as $5M. This is quite impressive given BROS sells pretty much only drinks at this point.

The number is from 2021, but each shop's AUV has grown with inflation quite a bit.

Since the box required only a little space with no amenities like heating and toilet for customers, it also has a higher Store-level EBITDA margin than its QSR peers.

How quickly the shop pays back depends on the initial investment which has 2 types: Built-to-suit and ground lease.

Built-to-suit sites require less capital but have higher rental costs, which means they will return cash faster if the store does well. Ground Lease takes more capital and time to get started but has lower rent. Doing quick math on the pre-opening cost, Ground Lease projects make up about 60% of all new projects in 2023.

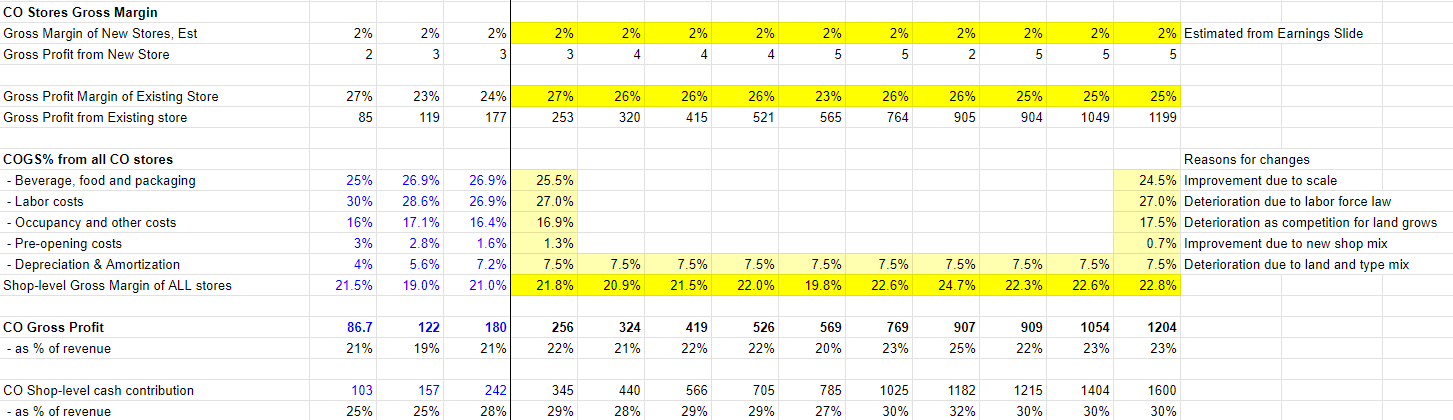

The company breaks down the gross margin below image. It takes about 4 quarters for the company to reach 25% gross profit or about 30%+ contribution margin (adding D&A back in).

Even though there are other costs outside of store-level COGS that grow with the number of branches such as marketing, logistics, and district managers; the unit economics look very good. This could be one of the reasons BROS decided to pivot the strategy to capture this excess ROIC on their own rather than giving it out to new franchisees.

The company has 16,000 employees working in company-owned stores at the end of 2023. That is almost 30 employees per store. Though they should have a lot of young part-timers, I can imagine that their box is going to be quite crowded.

Overall, BROS stores have great unit economics. The question remains whether these numbers deteriorate as white spaces get filled and competition heats up. But before that, let’s discuss BROS’ growth strategy.

Growth Strategy and Revenue Drivers

The company has been slowly expanding east toward Texas (2021), Florida (2024), and other states at a pretty fast pace. Adding 146 company-owned stores in 2023 and planning to add at least 165 this year.

“Well, the #1 gating factor for us is certainly people and our people system. And so it is so critically important that we are growing from within.” - Christine Barone, 2023 Barclays Eat, Sleep, Play Conference

Dutch Bros tend to expand city by city. Each time they launch a new city, they tend to go in big, launching several stores at once. This gives them leverage when they do paid marketing or set up a mass hiring event day. They typically choose locations that are somewhat far apart, and if those shops do well, they will look to open another shop between the two to saturate the area (the CEO called it “fortressing”). It’s quite like a land grab at the moment.

Barone points out that they need three main ingredients for growth: People, Real Estate, and Capital. She stated in a recent Barclays conference that people are their “#1 gating factor” to growth. However, she also said that the company currently has 375 operator-level employees who are ready to open up to 375 shops this year. These folks have been climbing the ladder from Broista (lowest level) to the Operator level for at least 3 years, and their average tenure is 7 years with almost 0% churn. This is somewhat contrary to the first statement she gave.

In terms of capital requirement, they expect about $300M of CapEx to expand 165 stores ($1.8M per store as openings skew towards ground lease but timing also played a role). Their 12-month-trailing Operating Cash Flow clocked in at $178M last year. It could reach $200M this year. This means that the CapEx required will still be materially higher but not too significant that they need to raise extra capital as they still have $260M of cash and equivalents.

Barone also points out that Real Estate is not the limiting factor to growth as well. I would agree as their good store unit economics allows them to pay up for good locations. However, two worrying points hinted that growth might not be as fast as investors expect. First, she still mentions that the company can open as many as 4,000 stores within the next 10-15 years, the same target that the former CEO set during the IPO 3 years ago. In some cases, she just said “15 years” outright, not 10. She also said that store expansion in Florida will be slower as they learned from Texas expansion that it takes time to build awareness there, unlike in California where people have heard of the brand already.

Overall, I think the company is opening as fast as it can without 1) raising further outside capital 2) putting a strain on their managers to the level that might affect service level, and 3) deteriorating unit economics. This is in line with the founder’s priority of keeping the Dutch culture alive and well as they expand.

Other initiatives

Apart from branch expansion, the company also has many initiatives to improve its stores’ P&L. This includes:

Online ordering and payment: BROS currently has a point collection app that which 66% of their customers use. Now they are implementing an online payment system (with OLO) as a new function. This is their main focus for 2024 as they cautiously roll out this service. This service should improve service speed during busy times but it could upsell drinks as well. However, if not implemented properly it can increase complexity and wait times for other customers like in the case of Starbucks.

Improved Marketing campaign: Deploy personalized notifications for those app users to improve sales on part days that the shops are less busy (instead of blasting generic promo). They also do paid marketing in some geography to build brand awareness in newer markets.

Drink innovation: Continually add new drinks to the list. Recently, their new series of drinks such as protein coffee, boba, and mangonada did well, raising Q1 2024 comps materially.

Process innovation: They are implementing the tap system which should make the Broista’s life easier. I think they will continue to come up with ways to improve the efficiency and cost of their service.

The CEO said the food menu will not be their focus in the near future. They also don’t plan to do delivery anytime soon as they cannot control the delivery experience and they can’t add human interaction in there.

Comparable Store Sales Growth and AUV

Part 2. Industry, Competition, and Long-term Questions

Why is Drive-thru Coffee growing?

From my research, drive-thru coffee chains benefit from three main trends: Americans eating out more, drive-thru gaining more popularity, and increased coffee consumption.

Even before the pandemic, drive-thru restaurants have been gaining in popularity for decades, growing much faster than the QSR industry itself. Why? This New York Times Article cited several reasons.

First, since the pandemic, people seem to become less social and prefer less interaction. I wonder whether the emergence of short-form video has made people less active, pairing that with car connectivity adds an extra layer of friction of leaving the car. Americans also seemed to be evermore pressed for time, and Drive-thru is the option that gives back time as orders are faster and food can be eaten during commute. Surprisingly, drive-thru being pet-friendly was also mentioned in the article.

Drive-thru tech improvement also played a role. Since In-N-Out implemented the two-way speaker in 1948, the drive-thru lane has been seeing upgrades lately. Innovations such as online ordering, faster payment, and, you guessed it, A.I., which helped with speech recognition menu personalization and so on. Dutch Bros along with brands like Chick-fil-A, however, decided to stick with human interactions and use the real neuron to remember each person’s name. But even then, they use iPads to send orders to the rest of the team.

The bottom line? People wanted more speed and convenience, and technology brought that to a drive-thru. The end of the pandemic doesn't seem to reverse this trend.

Delaget 2020 QSR Operational Index. Drive-thru sales % increased even before the pandemic.

In addition, Americans are also choosing to eat out more often as well due to convenience, selection, and culture shift.

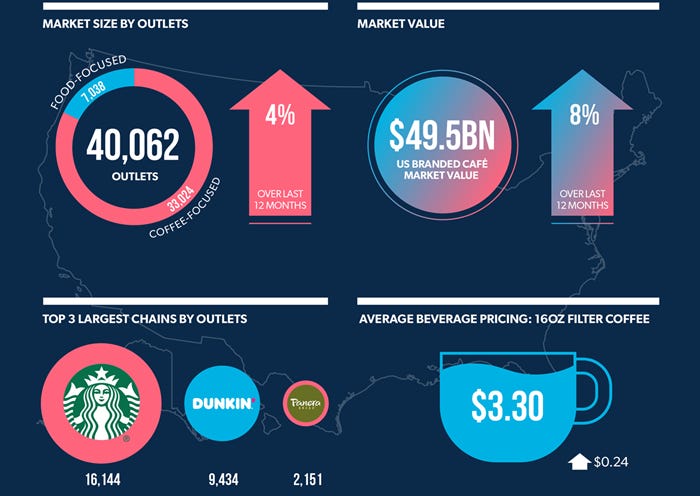

Finally, people are also drinking more coffee. “The US market is expected to surpass 45,200 outlets by September 2028, displaying five-year growth of 2.5% CAGR. The US branded coffee shop market exceeds 40,000 stores and surpasses pre-pandemic value.”

The chain could also benefit from meal-skipping which is getting more popular these days. For young generations, a full breakfast is no longer seen as necessity and could be replaced by a shake or a rich coffee. The rise of food costs also played an important part.

On the other hand, health-conscious trends and the promotion of GLP-1 drugs could hamper the growth, reducing the overall calorie intake of Americans. Macro factors like gas prices, inflation, and recession also play an important role in slowing down the aforementioned trend.

What is the Drive-thru coffee total addressable market?

In their S-1, BROS sees its TAM of $36 billion for the coffee category, the approximately $36 billion convenience store business, and the broader approximately $239 billion quick service restaurant (“QSR”) category where beverages are sold.

World Coffee portal estimated that there are now more than 40,000 coffee shops in the US and the number is expected to grow at about 2.5% CAGR until 2028. That is about 1000 shops per year. Although more than 50% of Dutch Bros sales come from non-coffee drinks, we will stick with the coffee shop TAM as other coffee shops also sell other beverages too.

In terms of sales volume. The $49.5bn US branded coffee shop market reached 104% of pre-pandemic value. Dutch Bros, with its system-wide sales of $1.4B is about 3% of that. This is not an insignificant number.

I somehow could not get any stats on the number of Drive-thru coffee shops in the United States. However, we know for sure that this number has been growing faster than the overall numbers as every player from Starbucks to all the QSRs is eyeing on this growth opportunity. Per foodservice research firm Technomic, drive-through traffic rose 30 percent from 2019 to 2022, much faster than overall branded coffee shop market growth. 2023 also sees the growth continue (not just a pandemic phenomenon).

For Starbucks, 70% of all US corporate stores now have drive-thrus, up from 58% in 2020. The company planned to outfit 90% of new stores with a drive-thru by 2021. Dunkin also mentioned that 64% of their stores will have a drive-thru in 2020. Due to the pandemic, I suspect the number is at least 70% as of today. Given smaller brands have similar portions of drive-thru stores, that would be about 28000 shops of drive-thru coffee and Dutch Bros stores also make up almost 4% of that.

Assume that the Drive-thru stores market grows faster at 6% per year. There would be 50000 stores by 2034. Dutch bros will have to grow its market share of shops to 8% (from 3%) to reach 4000 stores which means they have to take shares from somebody. That somebody, I believe, are the incumbents which has been quite stagnant lately:

Dunkin’s Store growth was pretty flat from 2019 to 2024, but they added 172 Stores (2%) from in the past year. 9630 Locations in 2019 and still 9641 as of March 2024.

Tim Hortons with 650+ stores in the US is also not growing.

Panera Bread is also stuck with 2100ish store counts from 2022.

Starbucks on the other hand is planning to grow its stores by 4% in the US, similar to the market growth, but judging from their recent struggle, could reduce openings in the next year.

At this rate, the players who, together, account for almost 30000 stores are only growing by 800 stores. This leaves another 1000 for BROS and their upcoming competitors to take the market share. (given the market grows at 6%, arbitrarily).

Another opportunity to take market share is from the QSRs and Convenient Stores which also sell coffee. According to Statista, the U.S. convenience store count has stayed flat at around 150,000 stores for more than a decade, while QSRs store count grew 2% per year to reach about 200,000 stores in 2024.

Who are the Competitors?

BROS vs LEGACY PLAYERS:

We have already discussed Dutch Bros’ unique selling point against legacy players like Starbucks, Dunkin, Panera Breads, and Tim Hortons in the first section, so I won’t repeat them here. These brands are losing market share to BROS and the newcomers as their shop growth is much slower. Although they sure seem to know about this threat, It is just not easy to adjust the service level and the real estate design in a year or two.

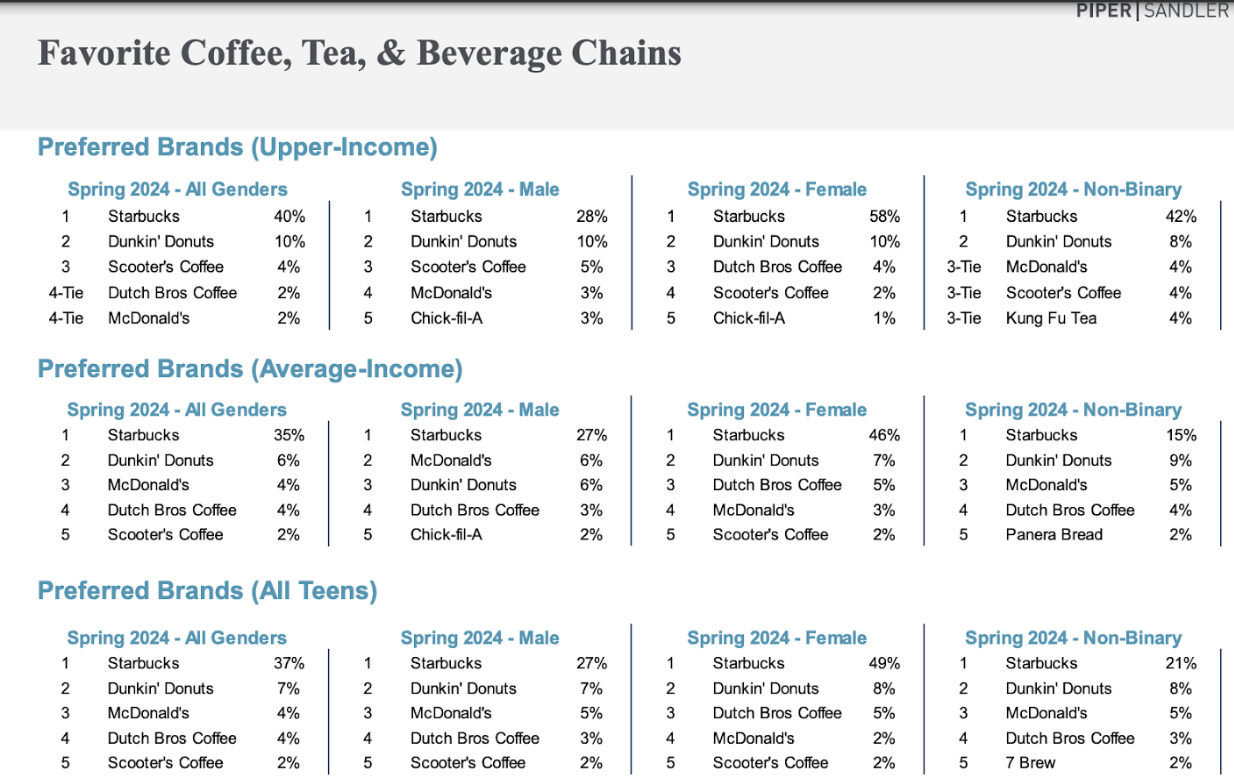

Google Maps reviews of their branches regularly show low 4-stars for Starbucks and 3-stars for Dunkin. However, they are still higher up the list when it comes to preferred brand surveys according to Piper Sandler. This could be because they are just ubiquitous. If you divide the preference percentage below by a number of locations, Dutch Bros seems to be at the top of the list for average income and teens.

But they aren’t standing still either. Starbucks, for example, also plans to open drive-thru-only coffee shops. Dunkin’s is also opening them. McDonald’s, another major coffee player, is also exploring this model with CosMc’s but so far the ratings come in pretty bad on Google Maps. They plan to open 9 stores in Texas in 2024.

BROS vs NEWCOMERS

BROS is not the sole rising star in this sector. The more I study, the more copies of Dutch Bros pop up everywhere in the country! As mentioned before, some competitors copy Dutch Bros to great success. Here is the rundown of emerging players in the space:

7 Brew Coffee: Founded only in 2017, 7 Brew has pretty much-copied everything that worked operationally for Dutch Bros from the menu to core values (speed, quality, service), the vibe, career path, to drive-thru design. (check out their marketing video). They then applied the model to the Midwest region, starting in Arkansas. The main difference is their expansion style. Last year they grew from 40 to 180 locations with their franchise model. Their CEO, coming from the real estate field himself, mentioned that they have up to 3000 stores committed in the future. He mentioned that their limiting growth factor is real estate, not the people. Seems like creating good service in drive-thru coffee is not that hard to replicate, not as hard as for QSRs.

They did particularly well in terms of funding the growth by receiving early investments from the founder of Jimmy John's, a successful sub restaurant with 2800 locations. This year, they announced a growth equity investment from Blackstone. To fund the growth, their franchisee raises money by selling the store to individual owners.

Some store’s AUVs are $2.4 million AUVs, 16% margins. Not bad at all. To me, they are one of the most formidable players because of their positioning and store economics. They are fierce and seem to have experience. The CEO sees his brand reaching 3000 stores in 5 years. Very ambitious.

Scooter’s Coffee: Started in Omaha, This brand is approaching 750 stores in 30 states, and the company plans to have more than 1,000 stores open by the end of 2024. Their store’s unit economy is worse than BROS though. Their drinks are more coffee-based and they also sell warm food and snack.

The Human Bean. started 25 years ago (also in Oregon!). It now has about 300 franchise branches and is still looking to expand but at a slower rate. Their branding and products seem to attract an older age group than BROS. Their investment required per unit ranges from 500k - 1M, significantly lower than BROS shops. Their median shop AUV is $880k in 2022 and it takes about 7 years for their franchisee to recoup the return.

Apart from these three, there are other emerging drive-thru players everywhere:

CaliCoffee is almost exactly like BROS. Based in Florida, it has 8 Locations some doing as high as $3M in AUV. They plan to open 20 more in the next couple of years.

Ziggi Coffee has 100 branches in the Midwest.

MOKA has 18 North Central region

Florence Coffee has about 40 branches in Montana

Biggby Coffee has 300 branches and plans to reach 1000 stores by 2028.

For many of these brands, I’m surprised by how similar they are to Dutch Bros.

Their product propositions are the same, focusing on Service, Quality, and Speed. Their core values are also similar: positivity, and friendliness with a touch of philanthropy and community. Even their marketing video looks similar!

Drinks are similar as well. Energy drinks. Lots of customization options.

They have a Next-gen drive-thru design. Double lane. Exit lane. Some have runners.

They have great ratings. Their shops are constantly getting more than 4.6 stars on Google Maps.

Their techs are pretty similar. Order screen. Loyalty points Apps. They will soon have mobile ordering

Clearly, the barrier to entry for this industry is minimal.

However, there are three major differences between them and BROS. First, the larger players (with 100+ shops) are all expanding via franchise while BROs just stopped franchising. They seemed to put more weight on securing white spaces than maintaining the service culture (yet they still have good ratings!).

Second, BROS seems to have a stronger fan base across the nation. In the comment section of their TikTok channel, I almost always spot comments where its customers ask BROS to open stores in their states. This is not the case for other brands.

Third, most of their stores still sell well. Looking through hundreds of branch bad Google Maps reviews, a lot of complaints on BROS are long wait times. This is not the case for their competitors nearby.

On the plus side, having competitors and copycats everywhere (except the Northeast region) shows that the BROS model will work well outside the East Coast and Texas. 7 Brew CEO also said they see themself as the Dollar General of Drive-thru Coffee, going in towns where even Starbucks doesn’t go. So this is another area where BROS could play in as well.

On the major minus side, competitors are filling the whitespace rapidly. From now on BROS will face as it slowly encroaches on these player’s turf to get to 4000 stores in 15 years. It will not be as easy as facing old players like Starbucks who simply cannot adapt its real estate strategy. As they enter a new market like Texas and Florida, Barone said that they cannot rely on their brand affinity like in the West Coast where they have been there for decades.

Is 4,000-store target achievable?

Even with branch density almost as high as their home state Oregon, which didn’t see store growth since 2022, BROS would achieve around 1900 branches for western states plus Arizona. Adding the middle section of America at a third of Oregon's density would get them another 2300. The Ten Eastern states would get them another 1200 stores. With this reasoning, 2 things must be true:

Requirement #1: New Coffee Drive-thru must work in the North East.

Interestingly, except for Starbucks and Panera Bread, none of the major coffee brands has been successful at expanding its store to the entire country. Dunkin stays mostly in the East. Tim Hortons stays in the North and Canada. I guess this is partly because of different tastes and habits, and also because the US is just a big place and nationwide scale is not a requirement to thrive in the coffee business.

For the new drive-thru coffee shops, the North Eastern states seem to be a real challenge. None of them have expanded to the North East Dunkin dominates. Can BROS one day enter this market? My take is that the BROS model likely works there too. After all, Dunkin' also has Drive-thrus. However limited real estate and higher competition could make the unit economics less appealing compared to the other regions, so they will just skip it first.

As of now, the Human Beans has 2 locations near Washington (opened for about a year now). They also have 2 locations in New Jersey, but they are not drive-thrus. If they were very successful, their franchisee should be expanding more than just 2 branches. So that doesn’t look too good. Will see how it goes in the next 12 months.

Requirement #2: Dutch Bros must be able to thrive in the competitive market.

BROS competitors are all looking to expand fast:

Starbucks is expecting 600+ (4%) U.S. store openings in 2024. And is eyeing to open a drive-thru-only shop.

7 Brew plans to open 3000 in 5 years. We’ll say at least 300 per year.

Scooter’s plans to reach 1000 stores by the end of 2024. 200 per year.

The Human Bean is aiming for 100 per year.

BROS itself should be planning to expand by 200 per year.

These 5 brands ALONE account for 1400 branch openings or 5% of the total coffee drive-thru we calculated already!

BROS is not going to out-expand its competitors. They simply can’t. This means that they must thrive in markets where they are second or third mover in order to reach their 4000-store goal. They have been shown to outcompete legacy players in the west so far, but the new battlegrounds like Texas have proof to be harder to ramp up AUV. In addition, the competition could get even tougher as BROS enters other’s home turf like the midwest.

Can they expand to the enemy’s territory? I still believe they can for the following reasons:

BROS has better shop unit economics as I mentioned earlier. Even as the company scaled up in Texas where competition is tough, the AUV in Q1 2024 still averaged $2.0M, significantly higher than the competitor’s number. Better Unit Economics allows Bros to have excess ROIC. Unless something happens, this should continue to be the case.

Being the second or third mover isn’t that bad in this business. Apart from loyalty programs, coffee has a very low switching cost. (one free drink campaign should be quite effective!). BROS can still take a share as long as their model is better.

There is less chance of them messing up over time. They seem to expand more cautiously than their counterparts who grow through franchisees. Managing their own stores should allow them to be more adaptable to change and have better quality control.

Even though I think BROS can expand to other places, I believe BROS's shop-level margin will be compressed as white spaces get filled and stores compete harder for customers. More shops simply means fewer customers per shop which causes margin to deleverage.

Unlike QSRs, BROS's drive-thru coffee business also has less complexity. Drinks are just harder to differentiate than food. You can also say that differentiation in the service level has an upper limit as well. Less moat (and less excess profit) in this part too. This is like retail but with less moat in scale advantage, Ugh! That said, I don’t think American brands will compete in the negative ROIC zone like the current Chinese coffee situation.

In short, my verdict is that they will be able to reach their 4000 stores target, but their overall shop margin will worsen from increased competition, especially in new stores.

Other factors affecting shop margin the long-term

Apart from sales deleverage due to competition, other factors could cause gross margin to drop. The most prominent one is the land and rental cost. Recently, there has been intense competition in real estate for drive-thru QSR. The price of land and development has been going up fast.

In June 2024, the CEO mentioned at a conference that a full-ground lease costs $1.9M while built-to-suit costs $0.7M for each branch. This is 40% higher than the previous number mentioned in its S-1 3 years ago, much faster than inflation. Furthermore, if the Fed fund rate goes down, this number could grow even faster. This rise is not just from macro pressure but also from competitors bidding up prime real estate.

Occupancy and other costs and D&A together have risen about 90 pts from 2022 to 2023.

Other than that, there are raw material costs that fluctuate with the coffee and sugar market. Wage increase also played a significant role in increased cost, but that could also bump up demand. We will hear more about how the $20 minimum wage bill in California impacts the company’s margin profile in the next quarter.

Part 3. Financial Modeling and Valuation

Alright! With all of this analysis, let’s make a financial model. To me, building a model helps me understand the business better and also helps me out what the market is expecting from the business.

I found MBI-Deepdive’s approach to valuation very useful so I will just use it here too (Thank you Rezwan!). He does a reversed DCF model where, after inputting all the variables, he will adjust the terminal FCF multiple so that the model will give him about 10% IRR (depending on the Risk-Free rate at that time). He then asks himself whether he is at least 90% confident that the number is achievable. If so, he usually buys. He goes through a much more in-depth reasoning of his approach here. It is worth a read even if you already have your process in place.

Number of Stores

For 2024, The CEO also mentioned in the Baird 2024 conference that she expects to grow the system shop count to a mid-teen range but acknowledged that they are growing a bit faster than that right now. However, she hinted that expansion in Florida will go slower than that of Texas made 3 years ago. Overall, they are and should be aiming for higher than mid-teen growth in the coming years to grab whatever whitespaces there is left.

For the longer-term forecast, the CEO said the company could reach 4000 in 10 to 15 years. So I modeled net new stores to reach almost 3100 in 10 years. She will have another 5 years to reach the 4000 store target. In addition, I predict one economic downturn in this forecast period where branch, store comps, and profit slow down immensely. This is what Starbucks faced before. I arbitrarily chose 2030 in this case.

There’s a chance that the company will grow beyond U.S. soil or have a new business line that requires less space, but I’m not going to underwrite any of those optionalities as they aren’t easy to do at all. As mentioned earlier, most brands even struggle to expand their model throughout the U.S.

Comparable Sales Growth

company-owned shops’ comparable sales growth:

Looking back over 5 years, BROS comparable sales grew about 2.8% CAGR, losing to CPI growth of 4%. Management expects LSD comps to be the norm. They explained that excellent Q1 comps were due to lapping last year’s bad weather and price increase, having extra days in February, and successfully introducing new drinks.

However, this doesn’t seem to be the case for Starbucks. Their comps beat CPI constantly even in the period where they are adding thousands of stores a year.

It seemed harder for drive-thru chains like Dutch Bros to increase spend per ticket as there is less degree of freedom to play with. Interaction time with customers is limited. The customer is mostly in a rushed mood. Adding a food menu might offset throughput, which is less of the case for Starbucks.

Predicting comps into the far future is quite hard. My best guess is the following:

-200 to -300 bps of Sales Transfer (own shop cannibalization) in line with what the CFO expects

+200 bps of menu price increase following inflation.

+300 bps new initiatives that ultimately increase traffic and spend per ticket discussed earlier in the growth section (Mobile Order and Pay, Personalized offerings, New Drinks, and Food menu in later years.)

Ultimately this means that BROS’ comparable sales growth will continue to slightly underperform CPI, just like in the 2019-2023 period.

Company-owned shop Revenue and Average Unit Volume (AUV)

To attempt to make the model more precise, I broke the company-owned shop revenue figures into 2 lines: New shops that were added in that year, and Existing shops that were added in all of the prior years. I also attempted to find their respective AUVs.

One prominent thing I found is that the AUV 2023 cohort is much lower than before (1.5M vs 2.1M in 2022). This is consistent with the analysts' concern about the company over-expanding in Texas. I continue to believe that future new stores AUV will be lower than existing stores but at a less extreme difference. In the model, this ultimately means that the AUV figures will grow slower than the comps.

[Side note: How I predict AUV for existing and new store.

BROS defines their AUV figure as the Average Trailing Twelve Months Sales Per Store for stores that are at least 15 months old. They decided on the 15-month (5 Quarters) cut off as the first quarter of new stores typically perform poorly. I did math and found that with 25% variable cost, sales in the first quarter of the opening date is about half of that of the fourth quarter where the store is considered somewhat fully-ramped.

That said, this makes it quite complicated to break down between new and existing shop revenue without drilling down to quarterly shop opening numbers. (I saw a model from Canalyst that broke down all shops into operating weeks but I think it will be an overkill for me, (and probably us!)). So, I decided to reduce the precision for the sake of simplicity by assuming that adding shops that are 12 months old would reduce the overall AUV number by about 1% each year. (About 8% of new shops are 12-15 months in each year, each sees 12% reduction in AUV (50% in Q1 vs Q5), multiply that and you get about 1% net decrease.)]

Company-owned shop Gross Margin

As discussed in a long-term question earlier, I expect the matured shop gross margin to be slightly lower as BROS faces tougher competition, this is offset by scale and process improvement. In this model. I underwrite 25% Gross Margin and 3.3 years cash on cash return.

That said, the blended gross margin will still trend higher in the coming years as a big portion of shops is still ramping up and has yet to generate a normal level of gross profit.

Franchise Revenue & Gross Margin

I made it even simpler to calculate Franchise Revenue, which is the following.

Franchise Shop Revenue = Average store in a given year x AUV of All franchise stores x Take rate

Where AUVs of all franchise stores are calculated to be about 90% of the company-reported franchise AUV. This number should rise slowly as the portion of new stores will be smaller, but new shops could be less profitable as white spaces get filled too.

As for take rate, in the past 3 years, BROS has earned about 17-18% of revenue from total franchise sales, much higher than 5% of their royalty fees as they also earn licensing fees, marketing fees, and sales of ingredients. I guess the licensing fee has a higher margin, I will slowly drop the take rate over time to reflect this.

The gross margin hovers between 65-75% in the last 3 years, so I keep them at 70%

SG&A and other Expenses

As the company grows, the SG&A cost per store should continue to trend lower due to the economy of scale. In the model, after crudely adjusting some one-time costs like IPO-related and relocation costs, I came to find that the SG&A costs per store were about 203k last year and have been trending down. Keep in mind that this is not a perfect number as franchise stores are included. I expect the company to continue to find leverage here until the EBIT margin reaches around 15% in 2033 which is higher than the current SBUX’s EBIT of 13%.

Interest expense will be reduced starting next quarter. I expect the company to raise a small amount of debt as their cash gets drawn. Income tax is set at 21%.

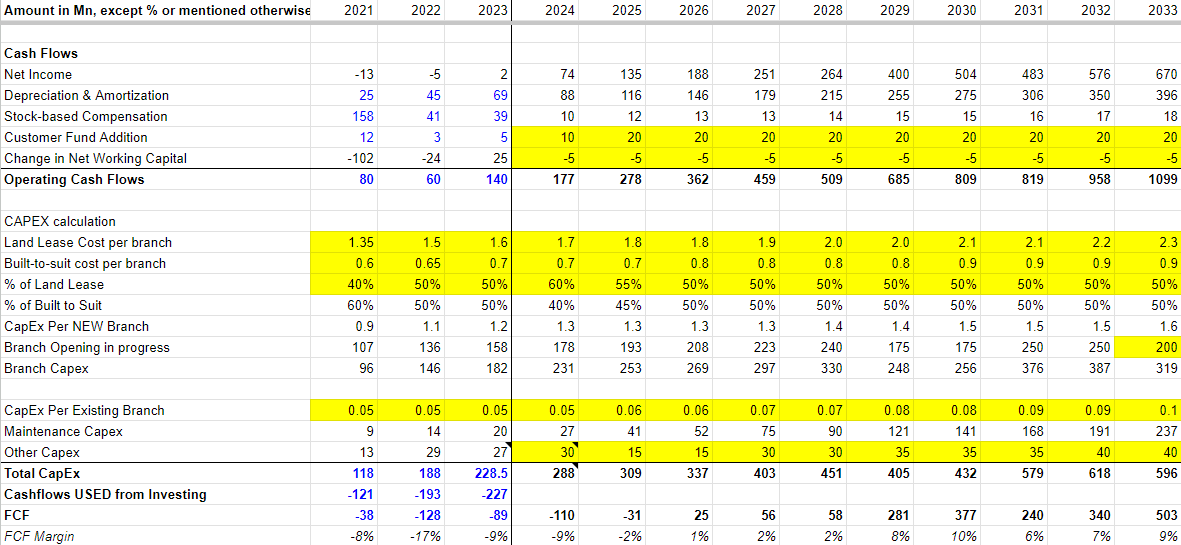

Cashflows, CapEx, FCF

I modeled some extra cash flow from BROS holding more of the customer's fund as they implement mobile ordering. SBC reduction will be discussed in the next section.

For Capex, management said that projects in 2025 will have more land leases to reduce the capital required for growth. I also expect the real estate cost to climb at the pace of inflation (and 5% in 2025). The company will face some one-time extra capex office expansion in Arizona. Capex per existing branch should also increase as the average age of branches increases along with inflation. Management expects $280-$320m of Capex in 2024.

Finally, Free Cash Flow is expected to turn positive around 2026 and grow from there.

IRR and Terminal FCF Multiple

From all of this, the terminal Price to Free Cash Flows multiple should be around 31x to provide a 10% IRR at the current stock price of $41. I think I will be more comfortable below 25x. Starbucks’s current FCF multiple is 23x with single-digit growth.

Please note that the DCF like this is quite sensitive to assumptions I have made. Later on, I might change these numbers as my view changes so please don’t take the model too seriously. If you want to change any of the assumptions, you can play around with the numbers here

Part 4. Management Team, Capital Structure, and Capital Allocation

The Team

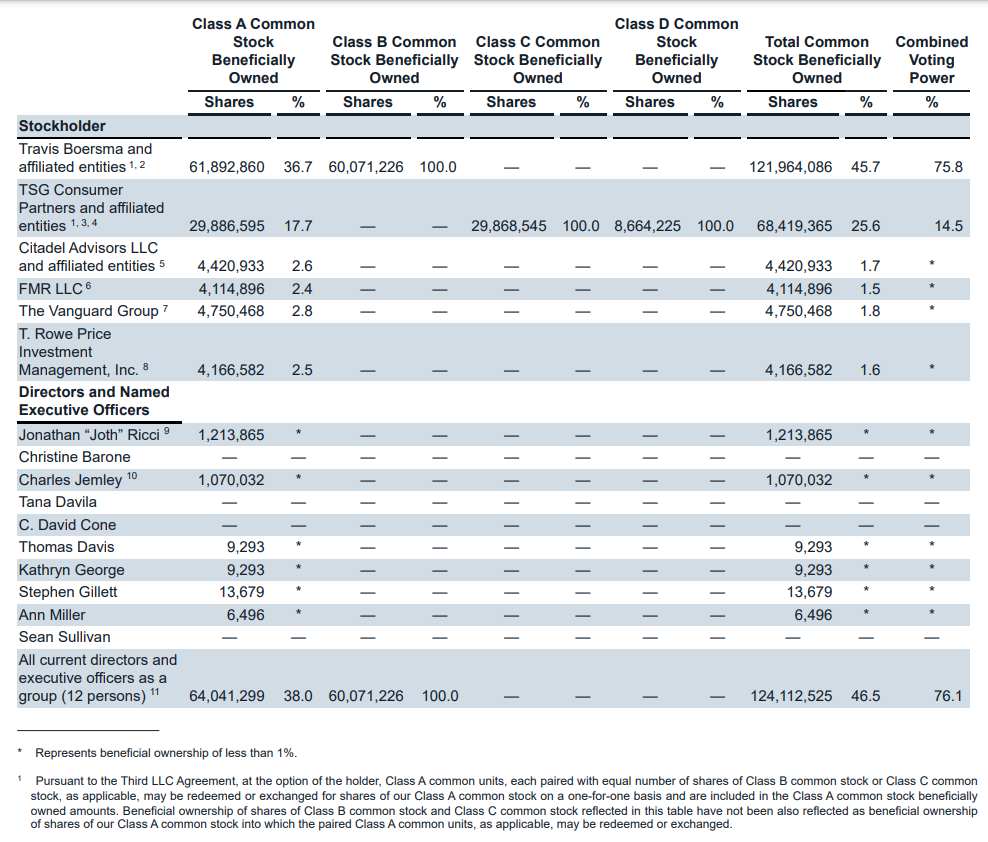

I have mentioned the founder, Travis Boersma, several times in this post. Other than still being influential in overall decision-making and culture, he is also the Executive Chairman of the board, receives a salary of $1.5M and owns 62 million shares at the end of 2023 which translates to about 35% of all shares, more than other shareholders by far. (Class B and Class C common stock in the table below has no economic right but has 10 votes per share).

And it’s not just Travis who is the OG, three of his family members are also in executive positions:

Brian Maxwell, our Chief Operating Officer, is Mr. Boersma’s brother-in-law.

Christine Schmidt, our Chief Administrative Officer, is Mr. Boersma’s sister-in-law.

Brant Boersma, our Chief Culture Officer, is Mr. Boersma’s nephew.

These members have been there for decades, so I don’t think there is any nepotism here. Rather, these folks help keep the Dutch culture alive and, I think, keep Travis in check as well.

In terms of control, he and his family still have absolute voting power in the company (75.8%). This is because the shareholding structure of Dutch Bros is designed so that the voting right is separated from the economic interest. Again, another sign that the Boersma is deliberate in maintaining its legacy and culture. This company has borrowed many chapters from the In-N-Out playbook.

Fortunately, the shares of each entity have the same value, so calculating the actual market cap is not hard. We just need to take into account all the shares that could be converted into regular class A BROS shares which, as of Q4 2023, amounts to 177 million shares. Be careful when looking at the per share stats of bros as many websites exclude some classes of shares.

Boersma, despite having a lot of control, seems to go well with the CEOs he selected. He was able to go along with the previous CEO, Joth Ricci, who led Dutch Bros from 317 branches when he joined in 2018 to achieve their target of 800 branches by the end of 2023 (QSR Magazine). Ricci passed the baton to Christine Barone, who before becoming the CEO of Dutch Bros, led True Food Kitchen from 21 to 46 branches during her tenure from 2016 to 2023 (QSR Magazine). Barone joined BROS one year before she took the role of CEO.

Although Barone didn’t have experience of scaling at the pace of hundreds of shops per year, she might know a thing or two about increasing the efficiency of the shop and managing people. From the first quarter so far, the new drinks seem to be spot on and the branch opening is on track.

Compensation

The compensation for BROS executives is quite straightforward, aligned, and reasonable.

First, Boersma is deemed as well aligned and receives a $1.5M annual salary without any further stocks award. He has no day-to-day work and is considered an advisor.

Barone in 2023 received a long-term incentive in terms of RSU totaling about $3M that vest 50% each on years 2 and 3 of the grant. She also received a salary of $625,000 with the chance to earn another 200% from the performance-based metrics.

The performance is based on 2 lines, revenue and adjusted EBITDA. While I prefer the performance to be based on EBIT rather than adjusted EBITDA, I don’t want to complain too much as SBC seems to be in control and some one-off costs such as reorgs and office relocation (to Arizona) are worth excluding if they are good for the company in the long term. Furthermore, the 100 and 200% targets are not set to be achieved easily and require proper outperformance from the team.

Capital Allocation

BROS IPOed in September 2021. Since then, it has been spending more cash than it earned to fuel its expansion. From my projection, this will be the case for a couple of years. Last year, it issued new shares, the first time since its IPO, to raise about $300M when the stock traded around $26. $206 of that amount was used to repay the line of credit while the rest was to fuel store expansion. In Q1 2024, it also issued a new debt of $150M at the rate of about 7%. The timing of issuance of stocks and debt could be better but, overall, there is nothing to fret about here. Some news cited the growing cost of development which 7 Brew CEO talked about in one of his interviews.

Stock-based compensation was high due to the previous IPO deal but is now expected to drop to about $8M, which is less than 1% of revenue and only about 0.1% a year. Very low!

Insider Selling

TSG, a venture capital firm that played an important part in Dutch Bros to the new level in 2018, has been liquidating its shares. They also plan to give up more control of the board. I don’t think this is alarming in any way either as it is their job to return money to their fund clients.

Travis and his Trust have been unloading his shares as well, selling almost 9 million shares (15% of their total holdings) since the beginning of the year. Travis, at the age of 53, still owns a lot of shares; however, his sales could indicate that the current share price is not cheap. This is something investors should continue to monitor.

Interestingly, despite a lot of insider selling pressure, share price still climbed a lot in the last 6 months along with other QSR names.

Part 5. Conclusion & My Take

For me, what surprised me the most after doing this research was the competition. Although BROS has survived and thrived among legacy players on the West Coast, I feel that the competition is just going to get tougher from now on. My estimates have shown that AUV of the 2023 shop cohorts are underperforming cohorts in prior years. It could also be that BROS was expanding too fast in one area as the CEO said, but that still isn’t a great sign.

While I don’t question the sustainability of BROS 'next-level service, I believe this drive-thru beverage business has lower moats than general QSRs because the operation is less complex and products are harder to differentiate. This makes me less certain about the company's ability to achieve both continuous shop-level returns and 4000 stores target at the same time in the next 15 years. Remember, the business model is not proven in the northeast yet.

With that, though, my model still assumes 3000 stores in the next 10 years (implying 4,000 stores in 15 years) and a 15% operating margin in 2034. Even with these assumptions, the valuation is still quite rich then as 31x P/FCF is required to achieve an IRR of 10%. Nevertheless, my model is quite conservative on AUV and same-store growth over time. In addition, I haven’t priced in the optionalities of BROS expanding beyond the U.S. soil or opening a new store format that requires less space. (BROS coffee cart?). The BRO-level service should still work there too.

The high valuation doesn’t just apply to BROS though, its high-growth peers such as CMG, SHAK, CAVA, and SG seem to have a lot of expectations built in as well. Maybe the streets are trying to find the next CMG. I will be more interested at 25x multiple, $34, but I might miss the stock forever XD. For now, I will see how the land grab pans among all of the competitors and how that affects the new shop AUVs in the coming years.

*****

Thank you so much for reading my first deep dive (in English). Please, please let me know what you think and how I can improve. Finally, I found this parody from Dude Dad making fun of Dutch Bros quite funny (because there’s probably some truth in it!). I hope this deep dive ends with a laugh XD.

*****

Q2 Update:

This deep dive was first posted in my test Ghost blog in June 2024. Right now, the second quarter result has come out and it wasn’t good. The stock dropped 20% to about $30 per share. Here’s a quick explanation of the drop.

Slower expansion than expected. They said they are going to come to a low end of the expansion target which is about 150 shops. This included franchise shops already. The CEO reasoned that they oversaturated Texas so they wanted to go slower in new markets like Florida. This should improve their AUV and new store profitability

The CEO, when asked about their long-term target, failed to reiterate the 4000 stores target number. I think she now has less conviction about that number.

Comp sales came out alright at about 5% but the CFO reiterated LSD comp growth for the whole year, meaning flat comp for Q3 and Q4, and this could be the case for 2025 as well. The restaurant sector might be cooling down a bit as people have less savings, and unemployment is ticking up again.

As for me, I haven’t bought any shares as I’m also concerned about the long-term TAM. I reduced the branch growth number in my model and will be more interested in about $25 range instead to remove the downside risk which is not insignificant.